On this page

Digital signatures via Adviser Online

What can I do if the Digital Signature request is declined or expired?

Digital Signature via Adviser Online

All Australian Retirement Trust Adviser Online Digital Forms, and most Non-Digital Forms, can be digitally approved via the integrated DocuSign function. This function provides an intuitive and efficient process for your clients to electronically sign forms you have submitted.

Step-by-step guide to Digital Signatures

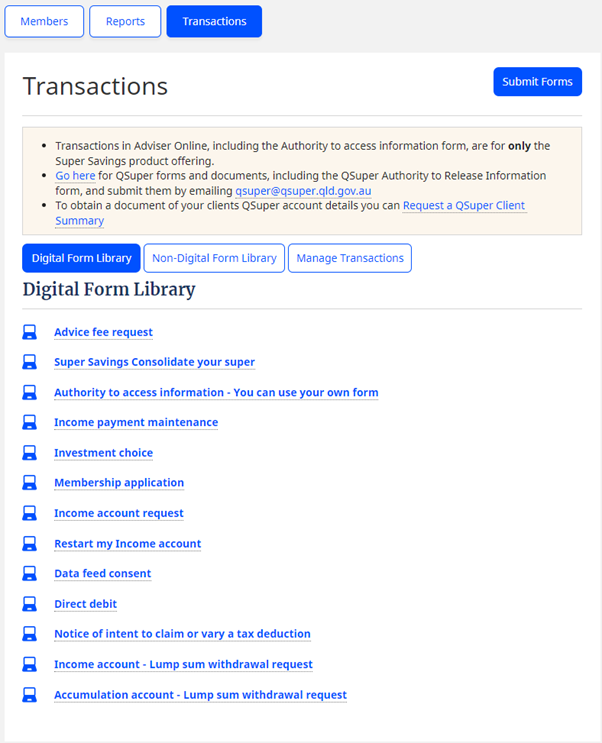

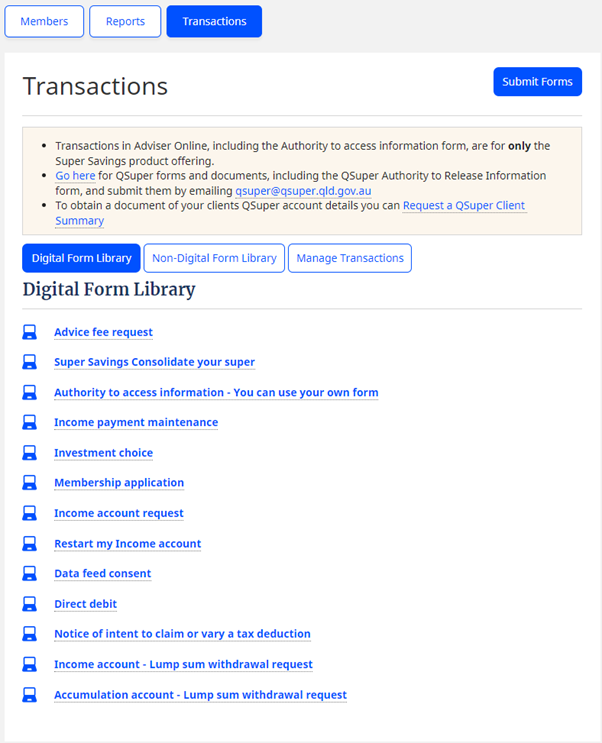

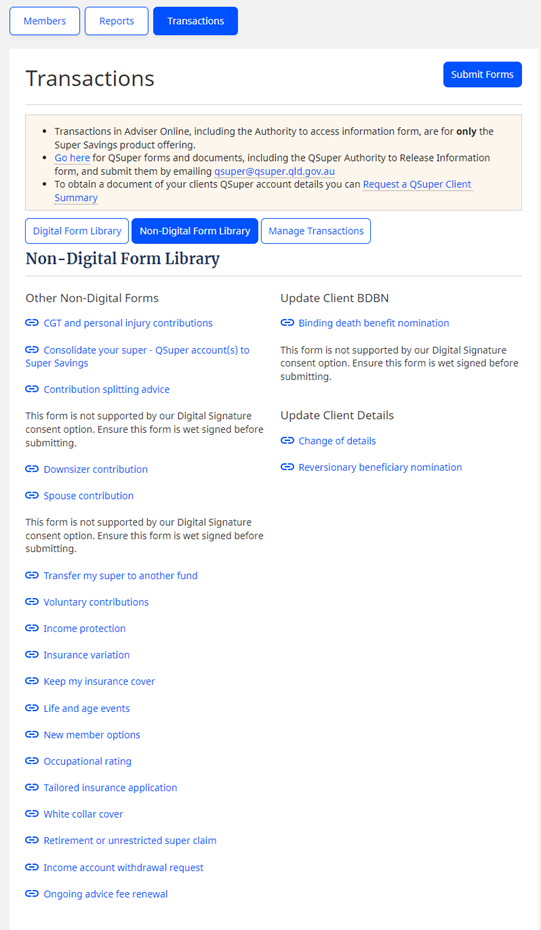

1. Select forms that can be digitally signed via the Digital Form Library and Non-Digital Form Library. Go Adviser Online > Transactions to access the form libraries. Go here for more information on Adviser Online Transactions.

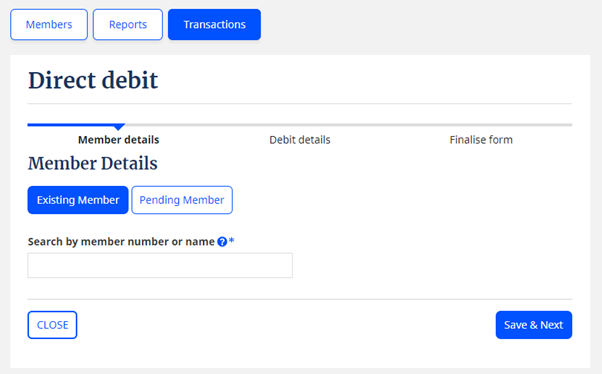

2a. For forms found in the Digital Form Library; Populate member and transaction details > "Save" & "Next" > "Generate PDF(S)".

2b. For forms found in the Non-Digital Form Library; Download a copy of the form and save it to your desktop and type the necessary instructions in the available fields. Do not print and scan this form if you want it to be approved via Adviser Online Digital Signature DocuSign.

3. Go to Adviser Online > "Transactions" and click on "Submit Forms".

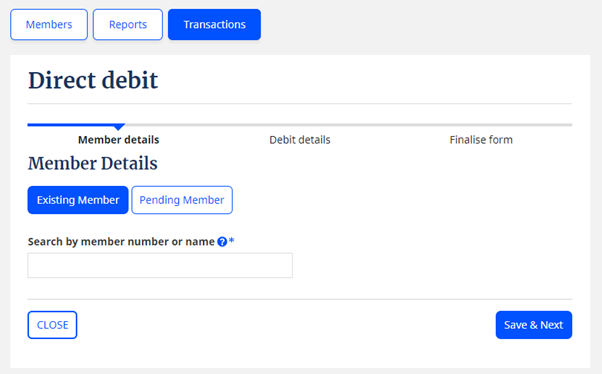

4. For existing members, select “Existing Member” and enter member name or number. For pending members, select “Pending Member” and enter the Request ID number from the Membership Application. Select the digital form(s) (if any) that you want to submit and click on “Next”.

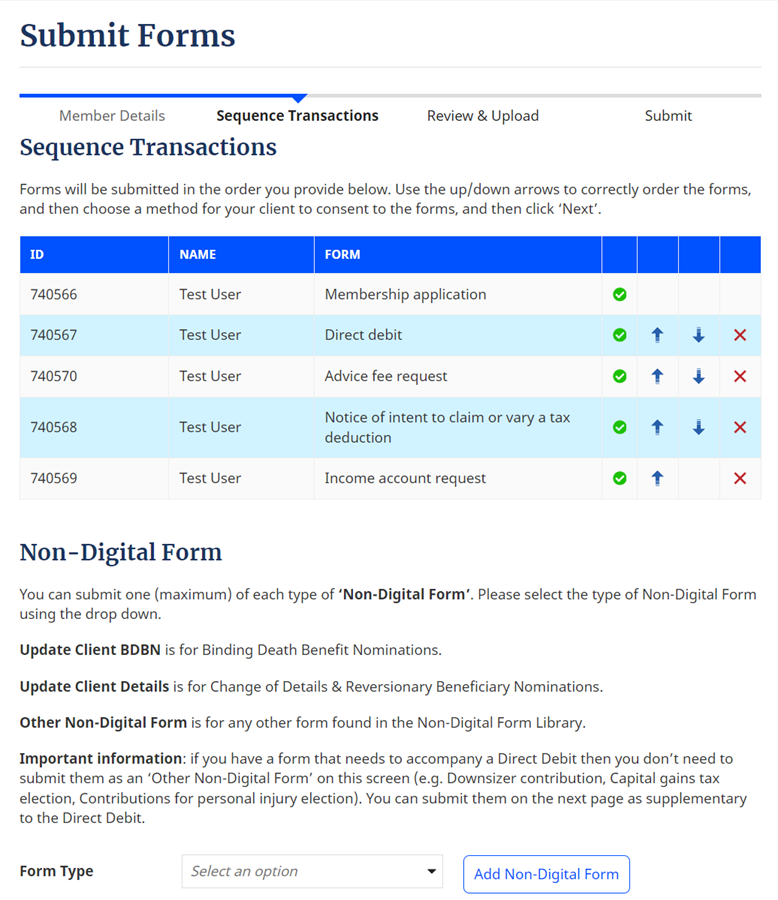

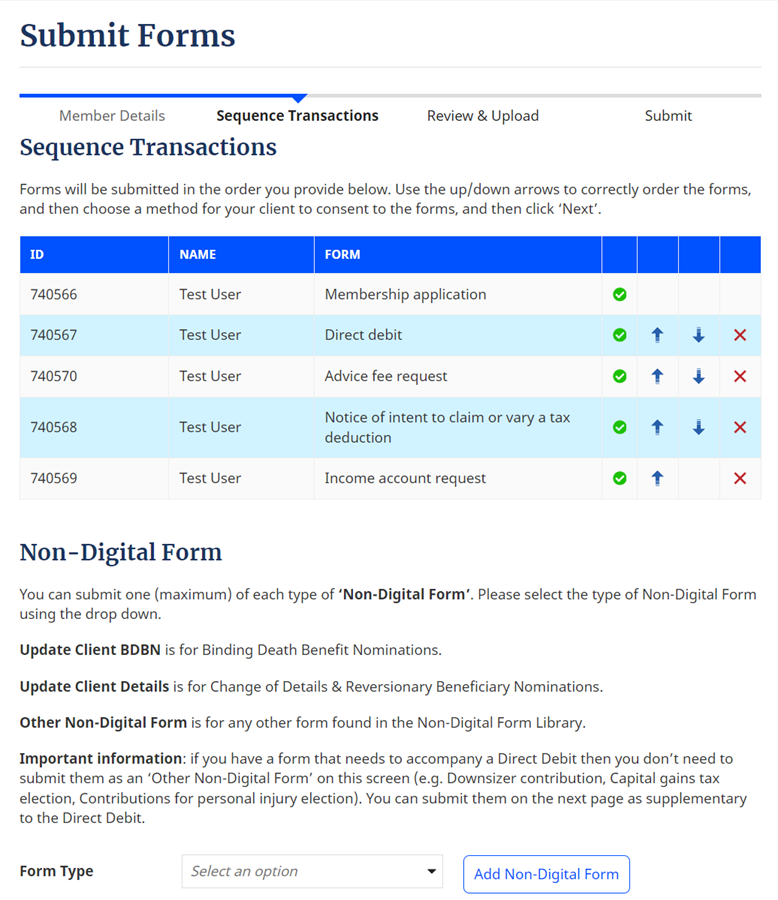

5. You are now on the “Sequence Transactions” milestone of "Submit Forms". This is where you can order the forms in your preferred processing order, noting some forms are required to be processed before other forms (e.g., if there is a Membership application, this will always be the first form).

6. Non-Digital Forms that cannot be digitally signed via DocuSign include: Binding Death Benefit Nomination, Contribution Splitting Advice, Spouse Contribution. These forms must be signed in handwriting and uploaded to the relevant section of Adviser Online.

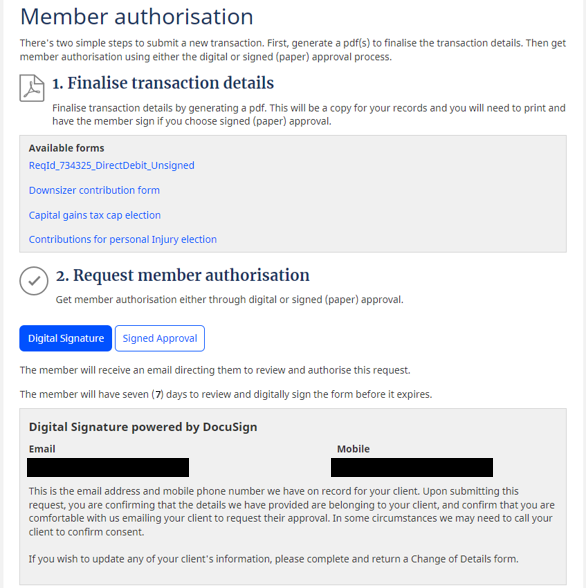

7. Choose the “Digital Signature” consent method.

NOTE: If we have your client’s email and mobile phone number on our records, then their email and mobile phone number will be prefilled. If they are incorrect, you can update them by submitting a Change of Details form. If we don’t have your client’s email and mobile phone number on our records, you can provide us with these details for the purpose of DocuSign, however your clients’ account will not be updated with these details. The mobile phone number must be an Australian mobile phone number.

NOTE: Non-digital forms that can be signed via DocuSign, should be downloaded from Adviser Online (Non-Digital Form Library) and must not be printed/scanned.

8. Click on “Next” to go to the “Review and Upload” milestone. Review the sequence of the transactions and upload any required forms and supporting documents, and then click on “Next”.

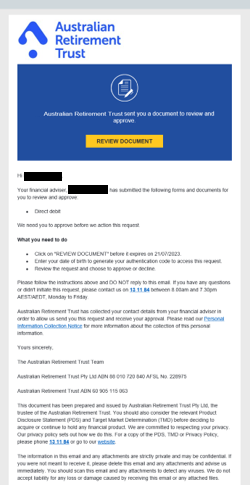

9. Submit your request to Adviser Online. Your client will receive an email and can click on the "REVIEW DOCUMENT" link in the email.

Email example

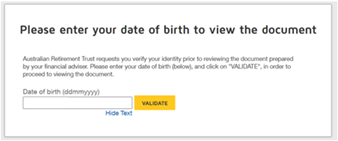

10. Client validates their Date of Birth.

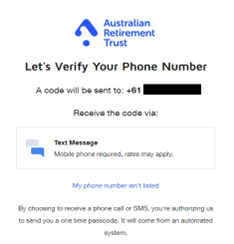

11. Client verifies their mobile number by receiving a one-time pin which is sent to their mobile phone via SMS. Client enters one-time pin to validate their mobile phone number.

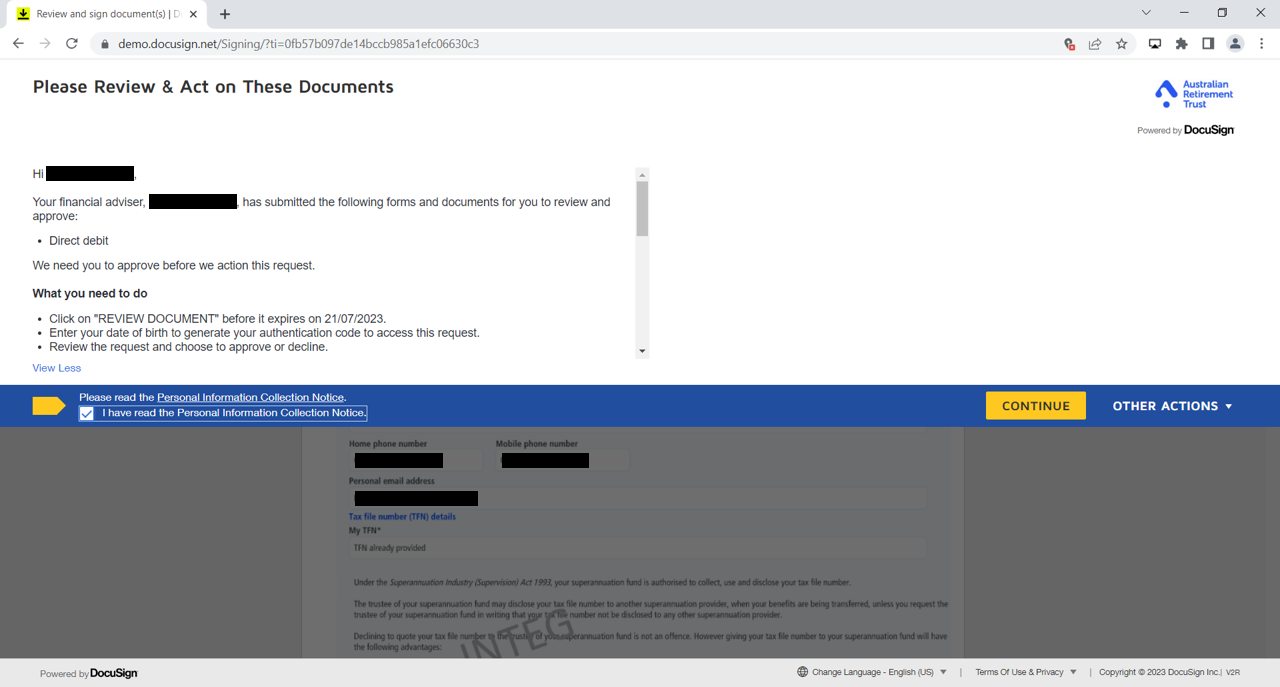

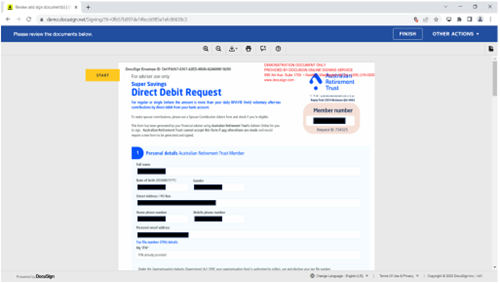

12. Client will then be directed to a screen with the form(s) they need to authorise.

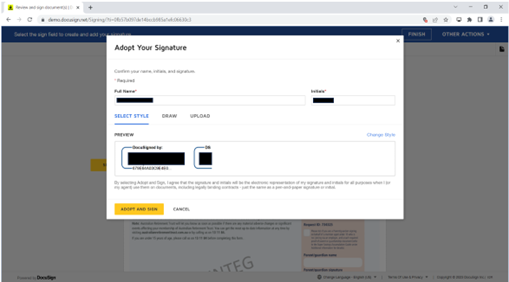

13. Client reviews the form(s), including disclaimers, and scrolls to the bottom of the form to digitally sign.

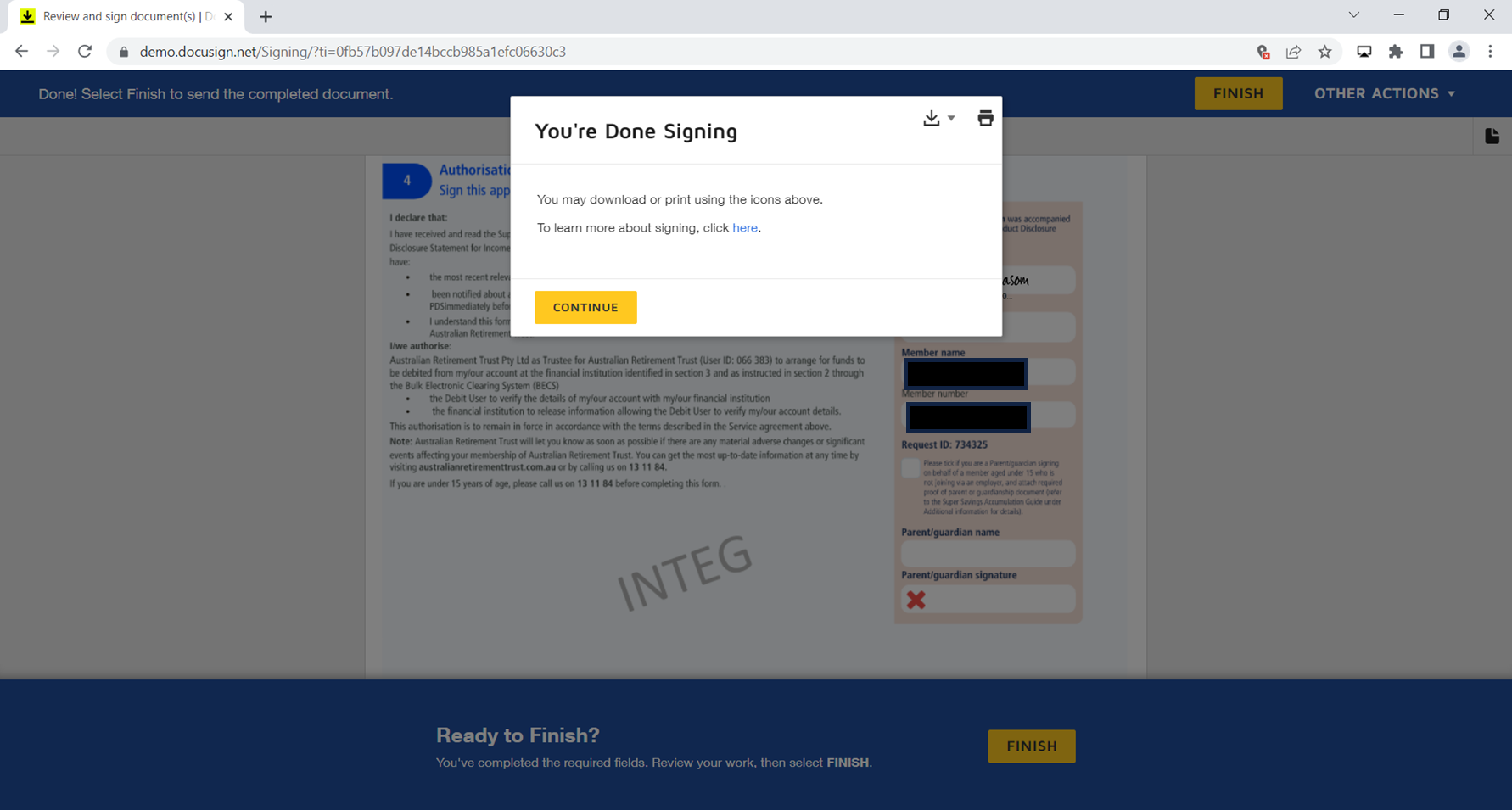

14. Client receives confirmation form(s) have been signed and the approval is sent to Adviser Online.

15. Your client receives an email confirmation that the form has been digitally signed, and Adviser Online will begin to submit the request forms to our internal teams for processing.

NOTE: Form(s) will be submitted for processing in the order that you’ve requested them to be submitted, and each form will not be submitted by Adviser Online until after the previous form(s) has been submitted/processed. The exceptions to this are the Change of Details and Beneficiary Nominations forms.

What can I do if the Digital Signature request is declined or expired?

If the request is declined by your client, or if it expires, you can call us and request the digital form(s) be rolled back so that you can edit or re-request them via Adviser Online when it makes sense for you to do so.

Signed Approval

All Australian Retirement Trust Adviser Online Digital Forms, and Non-Digital Forms, can be approved by your client using a handwritten signature. A handwritten signature is the only consent method available for Binding Death Benefit Nominations, Contribution Splitting Advice, and Spouse Contribution.

Step-by-step guide to Signed Approval

1. Select form(s) via the Digital Form Library and Non-Digital Form Library. Go Adviser Online > Transactions to access the form libraries.

2a. For forms found in the Digital Form Library; Populate Member and transaction details > Save & Next > Generate PDF(S). Print a copy of the form for your client to sign.

2b. For forms found in the Non-Digital Form Library; Download a copy of the form, save it to your desktop, and type the necessary instructions in the available fields. Print a copy of the form for your client to sign.

3. Go to Adviser Online > Transactions, and click on "Submit Forms".

4. For existing members, select “Existing Member” and enter member name or number. For pending members, select “Pending Member” and enter the Request ID number from the Membership Application. Select the digital form(s) (if any) that you want to submit and click on “Next”.

5. You are now on the “Sequence Transactions” milestone of Submit Forms. This is where you have the opportunity to order the forms in your preferred sequential order, noting some forms are required to be processed before other forms (e.g., if there is a Membership application, this will always be the first form).

6. Choose the “Signed Approval” consent method.

7. Click on “Next” to go to the “Review and Upload” milestone. Review the sequence of the transactions and upload any required forms and supporting documents, and the then click on “Next”.

8. Submit your request to Adviser Online.

9. Adviser Online will begin to submit the request forms to our internal teams for processing.

NOTE: With the exception of Change of Details and Beneficiary Nominations form(s) will be processed in the order that you’ve requested them to be submitted, and each form will not be submitted by Adviser Online until after the previous form(s) has been submitted/processed.