On this page

What transactions are available in Adviser Online?

- Digital Forms (found in the Digital Form Library)

- Other Forms (found in the Non-Digital Form Library)

Why use Adviser Online to submit forms?

How to use a Digital Form in Adviser Online

What does the Membership application form do?

What does the Income account request do?

What does the Advice fee request form do?

What does the Authority to access information form do?

What does the Data feed consent form do?

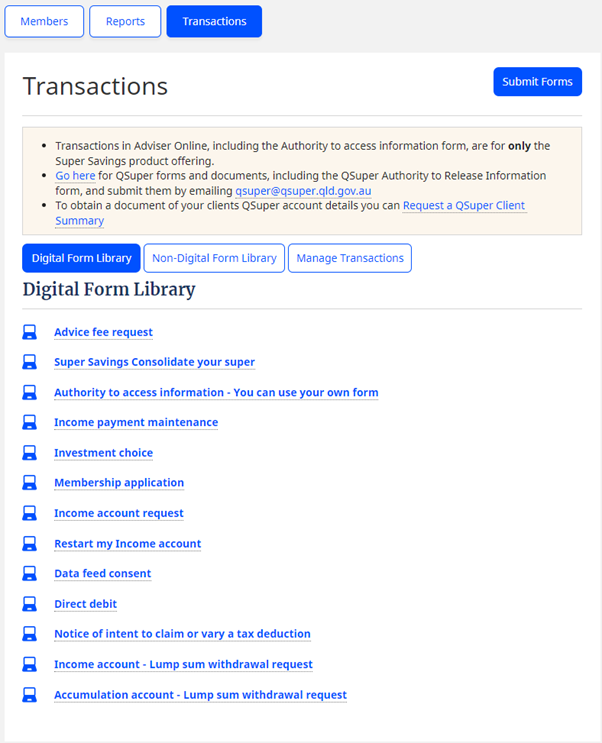

What transactions are available in Adviser Online?

All transactions related to Super Savings accounts can be accessed and submitted via Adviser Online.

Digital Forms (found in the Digital Form Library):

- Advice fee request

- Super Savings Consolidate your super

- Authority to access information

- Income payment maintenance

- Investment choice

- Membership application

- Income account request

- Restart my Income account

- Data feed consent (only available once you have enabled your data feed)

- Direct Debit

- Notice of Intent to Claim or Vary a Tax Deduction

- Income account – Lump sum withdrawal request

- Accumulation account – Lump sum withdrawal request

Non-Digital Forms (found in the Non-Digital Form Library):

- Binding Death Benefit Nomination

- Change of Details & Reversionary Beneficiary Nomination

- Other Non-Digital Forms, which includes:

- ATO forms (Downsizer, CGT election, Personal injury election)

- Ongoing advice fee renewal

- Consolidate your Super – QSuper account(s) to Super Savings

- Income account withdrawal request (to be used for ad hoc income payments)

- Insurance forms

Why use Adviser Online to submit forms?

Adviser Online provides a safer and more secure way for you to submit forms on behalf of your client. Submitted forms are easier for you, and us, to track - enabling us to work collaboratively when processing forms for your client (our member). Forms submitted through Adviser Online are prioritised to ensure you receive an improved service when compared to submitting forms via other channels (e.g. email).

How to use a Digital Form in Adviser Online

- Click on Transactions and go to the Digital Form Library

3. Select the Digital Form that you require.

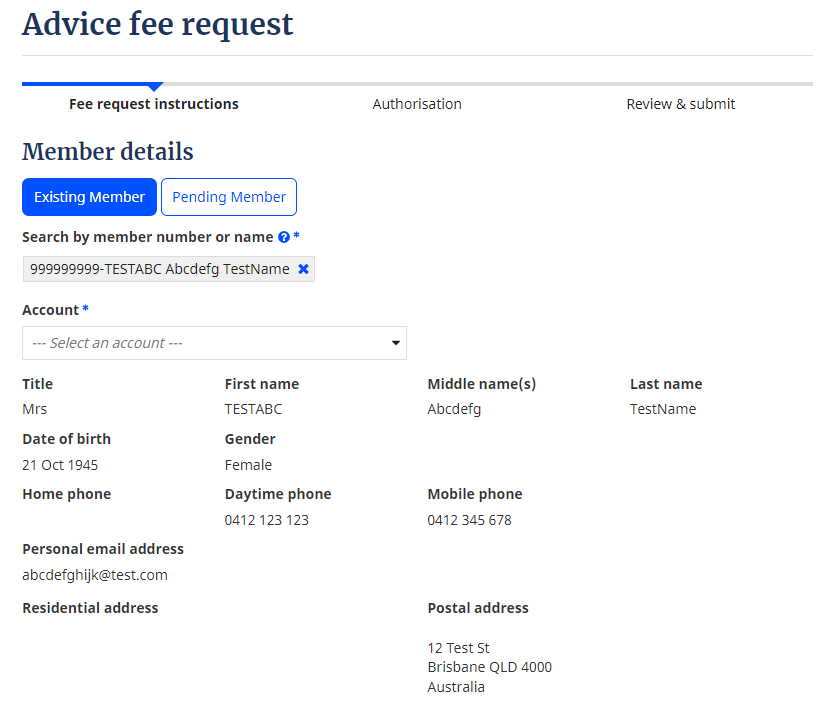

4. Select the client or enter the client’s details.

4a. Most transactions in Adviser Online will allow you to search by member number or name and your client's details will be pre-filled.

4b. For Membership application and Authority to access information, you’ll need to enter your client’s details because this member is not yet connected to you in our systems.

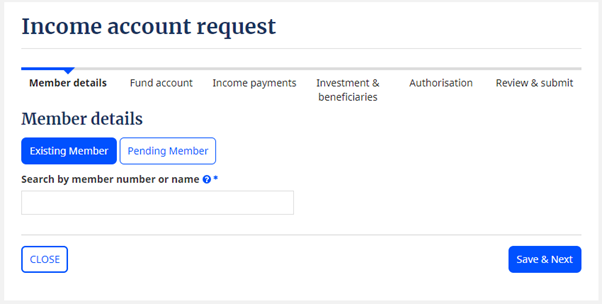

4c. Some transactions, like Income account request, have the option of selecting "Pending Member". This allows you to generate a form for a client in the scenario where they do not yet hold a Super Savings account. Using "Pending Member" requires you to first generate a Membership application to obtain a Request ID. Request ID can be found on the generated Membership application form and can also be found in Adviser Online > Manage transactions. To locate the Request ID on the Membership application PDF refer to the bottom left of every page, toward the top right-hand corner of the first page, and also within the signature block.

5. Complete the form as required. This is a smart form; your selections will determine what options you are provided. Click Save & Next to save your work.

6. Once you’ve finalised the form and you’re ready to submit, you’ll then need to go to Transactions > Submit Forms.

You can go back and edit forms up until you request Adviser Online to submit them. You can either print the digital form(s) and have your client provide their consent via handwritten signature (Signed Approval), or you can send the digital form(s) via Digital Signature (DocuSign integrated with Adviser Online). Learn more about Client Authorisation here.

What does the Membership application form do?

This form allows you to send us a request to commence a new member account, including the provision of an Authority to access information, Investment choice, opting in / opting out of our default insurance arrangement, and Super Savings Consolidate your super.

Important things about the Membership application:

- You will need to provide us with a legible identification document that shows full name, date of birth and signature (e.g. Driver Licence).

- Ensure you provide your client with an accompanying Super Savings Product Disclosure Statement for Accumulation Account, and ensure they have confirmed via the signed form that they have received a copy of it.

- You may choose to provide a client’s TFN. The TFN is validated at the time of entering. You cannot add this at a later date manually. You will need a TFN Notification form (which can be found in the Non-Digital Form library).

What does the Income account request form do?

If you have an active authority on an existing Super Savings member account or you've just generated a Membership application form via Adviser Online, this form will allow you to request the commencement of a new Income account. If you're establishing an Income account for a client that does not yet hold a Super Savings account, then you'll need to take note of the Request ID on the completed Membership application form. To generate an Income account request for a "Pending Member", input the Request ID found on the generated Membership application form (and that can also be found in Adviser Online > Manage transactions). To locate the Request ID on the Membership application .PDF refer to the bottom left of every page, toward the top right-hand corner of the first page, and also within the signature block.

You will need to provide us with details of your client’s identification (Medicare card, Australian Driver Licence, or Australian Passport) so we can electronically verify your client.

Important things about the Income account request form:

- You will need to provide us with your client’s bank details and a copy of their bank statement. (The bank statement if not required if your client is approving the transaction via digital approval).

- You will need to provide us with details of your client’s identification (Medicare card, Australian Driver Licence, or Australian Passport) so we can electronically verify your client.

- You will need to ensure that you’ve entered your clients bank details and identification details on the form itself.

- Ensure you provide your client with an accompanying Super Savings Product Disclosure Statement for Income Account and Lifetime Pension, and ensure they have confirmed via the signed form that they have received a copy it.

What does the Advice fee request form do?

With this form, you can request payment from your client for the advice you provide.

This task is only available via Adviser Online.

The form provides a member’s authority for advice fees to be paid from their Super Savings account to the nominated adviser for the express purpose of providing financial advice that meets the sole purpose test requirements of the Superannuation Industry (Supervision) Act 1993.

For more information, please refer to the Advice Fees FAQs.

What does the Authority to access information form do?

Once signed by your client, this form provides authority for you to access your client's Super Savings account information. Once you have authority on your client’s Super Savings account, then you will be able to use Adviser Online for creating and submitting forms.

Australian Retirement Trust acknowledges that some advisers prefer to use their own Authority to access information, and Adviser Online allows you to do this - You can submit your own Authority to access information by selecting the available option "Use Your Own".

Alternatively, you can use our version of an Authority to access information and request your client to sign it via Digital Signature (DocuSign integrated with Adviser Online).

What does the Data feed consent form do?

This form is only made available once you have enabled a data feed to your advice software. It provides us with the members explicit consent that it is OK for us to send their account information via a data feed to your advice software. Your client’s data generally begins transmitting via the data feed within 48 hours of the approved form being uploaded to Adviser Online.